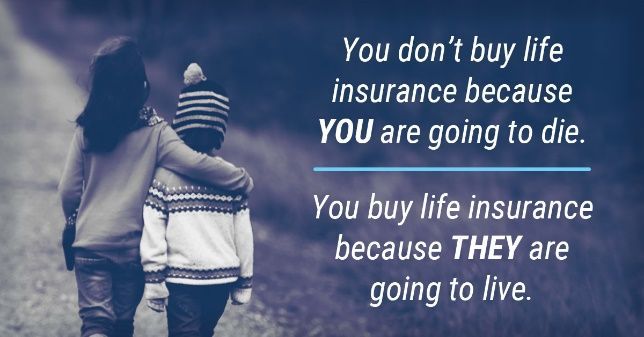

We can help with life insurance as well as a variety of other needs.

We build our flexible options to meet your goals, whether you’re just beginning to consider your financial future of are handling a challenging circumstance. We support you in developing specialized solutions that fit your needs and budget while providing clear explanations of our product.

What types of insurance is there?

Learn more on the different types and what they cover.

Get a Quote

Contact Us

It all begins with you.

You’re prepared to take steps in protecting the people you love and making plans for the future. If you know what you need or simply have a few more questions, fill out the form below and we’ll connect with you. We want to help you!

Your needs are specific.

There is no preset answer because what is important to you and what you want to achieve are unique.

Get what you desire.

You can better understand your options and find the right combination of benefits by speaking with an expert.

A reliable agent at your side.

We will support you at every turn as your needs and situations change.

Let's Learn more about you.

What types of Life Insurance are there? Click on the boxes below to learn more about the details of each type.

Learn more with articles

Not sure of you needs?

Let's talk and figure out the best plan for your current situation and needs.